Mexico Consumer Lending Market Overview

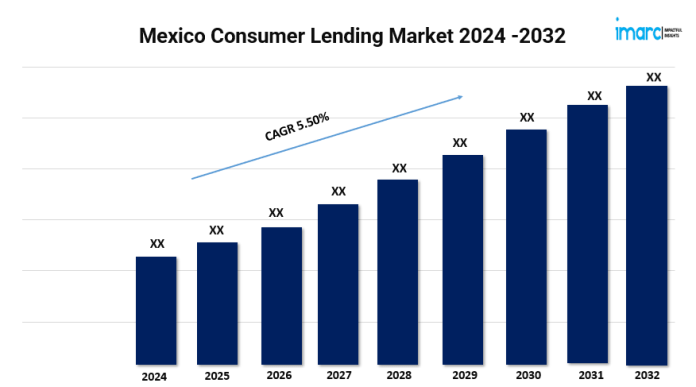

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 5.50% (2024-2032)

The governing body, in collaboration with financial institutions, is actively promoting the inclusion of previously unbanked and underbanked populations into the formal financial system in Mexico. According to IMARC Group, the Mexico consumer lending market size is projected to exhibit a growth rate (CAGR) of 5.50% during 2024-2032.

Grab a sample PDF of this report: https://www.imarcgroup.com/mexico-consumer-lending-market/requestsample

Mexico Consumer Lending Industry Trends and Drivers:

Efforts like the introduction of simplified banking products, mobile banking services, and financial literacy programs are improving the accessibility of credit to a broader segment of the population in Mexico. Moreover, intensive marketing and awareness campaigns by financial institutions are effectively promoting consumer lending products. Through various channels, including social media, digital marketing, and traditional advertising, lenders are raising awareness about the benefits and availability of consumer loans. These campaigns are educating people on the different credit options, how to use them responsibly, and the positive impact of borrowing on achieving personal goals.

Additionally, the adoption of digital technologies is streamlining loan application processes, improving credit assessment accuracy, and enhancing client experience. Financial technology (fintech) companies, in particular, are at the forefront of this transformation, offering innovative lending solutions that cater to the needs of tech-savvy individuals. The integration of artificial intelligence (AI), big data analytics, and blockchain technology is further optimizing lending operations, making it easier and faster for users to access credit. Besides this, regulatory authorities are implementing measures to promote transparency, protect clients, and ensure the stability of the financial system. These reforms are increasing user trust in financial institutions and encouraging more individuals to engage in borrowing activities. The regulatory environment is also fostering competition among lenders, leading to better loan terms and conditions for people in the country. In addition, many people are embracing digital platforms for purchasing goods and services, which is driving the demand for credit to facilitate these transactions. Many online retailers and e-commerce platforms offer financing options and installment payment plans, making it easier for buyers to access credit and manage their expenditures. This integration of lending solutions within the e-commerce ecosystem is expanding the reach of consumer loans. Apart from this, the growing focus on enhancing user experience among financial institutions is offering a favorable market outlook in the country. Lenders are investing in customer-centric approaches, leveraging technology to provide personalized and seamless services. Features like online loan applications, instant approval, flexible repayment options, and responsive client support are improving the borrowing experience.

Explore full report with table of contents: https://www.imarcgroup.com/mexico-consumer-lending-market

Mexico Consumer Lending Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Personal Loans

- Credit Card

- Auto Lease

- Home/ Mortgage Loans

- Others

Application Insights:

- Individual Use

- Household Use

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145