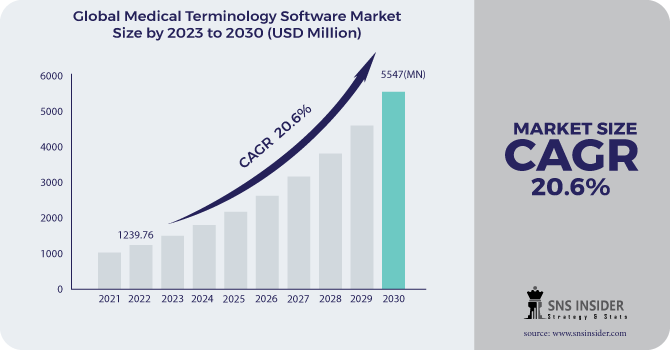

The global Medical Terminology Software market size projected to increase from USD 1.25 billion in 2023 to an impressive USD 6.21 billion by 2032. This substantial growth, representing a compound annual growth rate (CAGR) of 19.5% over the forecast period from 2024 to 2032, highlights the growing importance of advanced software solutions in the medical and healthcare sectors.

The accelerating market growth is driven by several factors, including the increasing adoption of electronic health records (EHRs), the need for standardized medical coding, and the rising complexity of healthcare data. Medical terminology software facilitates accurate and efficient medical documentation, coding, and data management, playing a crucial role in improving healthcare delivery and operational efficiency.

Transforming Healthcare with Medical Terminology Software

Medical terminology software is essential for the accurate coding, documentation, and communication of medical information. These solutions help healthcare professionals standardize medical terms, manage vast amounts of clinical data, and ensure compliance with regulatory requirements. By providing comprehensive and standardized medical vocabularies, such as SNOMED CT, LOINC, and ICD, medical terminology software supports the seamless exchange of health information across different systems and platforms.

The adoption of medical terminology software enhances clinical documentation, billing processes, and data analytics. It reduces the risk of errors, improves data accuracy, and streamlines administrative tasks, allowing healthcare providers to focus more on patient care. Additionally, these solutions support interoperability and data sharing, which are crucial for coordinated and effective healthcare delivery.

Get a Free Sample Report : https://www.snsinsider.com/sample-request/2035

Market Dynamics and Key Drivers

The impressive growth of the Medical Terminology Software market is driven by several key factors:

- Increasing Adoption of EHRs: The widespread implementation of electronic health records (EHRs) is driving the demand for medical terminology software. EHRs require accurate and standardized medical terminology for effective documentation and data management.

- Need for Standardized Medical Coding: Standardized medical coding is essential for accurate billing, insurance claims, and data reporting. Medical terminology software provides the tools needed to manage and apply standardized codes efficiently.

- Growing Complexity of Healthcare Data: The increasing complexity and volume of healthcare data necessitate advanced software solutions for accurate terminology management and data integration. Medical terminology software helps manage this complexity by providing comprehensive vocabularies and coding systems.

- Regulatory Compliance: Compliance with regulatory requirements, such as those set by the Health Insurance Portability and Accountability Act (HIPAA) and the International Classification of Diseases (ICD), is driving the adoption of medical terminology software. These solutions ensure adherence to regulatory standards and improve data accuracy.

- Focus on Data Interoperability: The push for data interoperability and seamless information exchange across healthcare systems is driving the demand for medical terminology software. Standardized terminology supports effective communication and data sharing among different healthcare providers and systems.

Challenges and Opportunities

Despite the robust growth trajectory, the Medical Terminology Software market faces certain challenges. Data security and privacy concerns, integration with existing healthcare systems, and the need for continuous updates to medical vocabularies are significant barriers. Additionally, the complexity of implementing and maintaining medical terminology software can be challenging for some organizations.

However, these challenges present opportunities for innovation and growth. Companies are focusing on developing secure, user-friendly, and adaptable medical terminology software solutions. Collaborative efforts between healthcare providers, software developers, and regulatory bodies are paving the way for improved solutions and smoother adoption.

Key Market Players

The Medical Terminology Software market is characterized by a competitive landscape with several key players driving innovation. Prominent companies in this sector include:

- IBM Watson Health: Known for its advanced AI and data management solutions, IBM Watson Health offers robust medical terminology software for clinical documentation and data integration.

- Cerner Corporation: Cerner provides comprehensive medical terminology software as part of its EHR and health information management solutions.

- Allscripts Healthcare Solutions: Allscripts offers medical terminology software that supports accurate coding, documentation, and interoperability in healthcare settings.

- Meditech: Meditech’s software solutions include medical terminology tools that enhance clinical documentation and data management.

- Philips Healthcare: Philips provides innovative medical terminology software solutions designed to improve healthcare delivery and data accuracy.

Future Outlook

The future of the Medical Terminology Software market is promising, with continued advancements in technology and data management driving growth. As healthcare organizations increasingly adopt electronic health records and seek standardized solutions for medical coding and documentation, the market is expected to expand significantly. Ongoing research and development efforts, coupled with rising awareness of the benefits of medical terminology software, will contribute to sustained growth.

In conclusion, the Medical Terminology Software market is set to experience substantial growth, transforming the way healthcare data is managed and communicated. With its potential to enhance accuracy, streamline operations, and support regulatory compliance, medical terminology software is poised to become an indispensable tool in modern healthcare.

Other Reports You May Like:

Computer Vision in Healthcare Market Size

Healthcare Virtual Assistants Market Size

Precision Medicine Software Market Size