Navigating the complexities of business taxes in the UK can be a challenging task, especially for small business owners and new entrepreneurs. A company tax account is a crucial tool for ensuring that your business remains compliant with HM Revenue and Customs (HMRC) and can manage its financial obligations effectively. This guide will provide you with detailed insights on how to set up, manage, and optimize your company tax account, ensuring you stay on top of your business’s financial health.

The Importance of a Company Tax Account for UK Businesses

A company tax account is more than just a legal requirement; it is a key component in managing your business finances. This account allows businesses to:

- Efficiently Manage Tax Payments: Whether it’s Corporation Tax, VAT, or PAYE, a company tax account helps you stay organized and ensure that all tax payments are made on time.

- Access Government Resources: Through your company tax account, you can access various HMRC services, including filing tax returns, managing employee payroll, and staying updated on new tax regulations.

- Optimize Financial Planning: Proper management of your company tax account enables better financial planning, allowing your business to maximize tax reliefs and minimize liabilities.

- Maintain Legal Compliance: Keeping your tax account up to date is essential for avoiding fines and penalties, which can otherwise become costly for your business.

Step-by-Step Guide to Setting Up a Company Tax Account in the UK

Setting up a company tax account is a straightforward process, but each step must be carefully followed to ensure compliance with HMRC regulations. Here’s a detailed breakdown:

1. Register Your Business with Companies House

The first step in setting up your company tax account is to register your business with Companies House. This is mandatory for all limited companies in the UK. Registration involves providing details about your company, including its name, address, and directors. Once registered, HMRC is automatically informed, and you’ll receive a Company Registration Number (CRN).

2. Create a Government Gateway Account

A Government Gateway account is essential for interacting with HMRC online. This secure portal allows you to manage your company’s tax account, file returns, make payments, and access other important services. Creating this account is a simple process and requires basic company information, including your CRN.

3. Register for Corporation Tax

Once your Government Gateway account is set up, you need to register for Corporation Tax in the UK. This must be done within three months of starting any business activities. During this process, you’ll provide details such as your company’s registration number and the date your business began trading. HMRC will then issue a Unique Taxpayer Reference (UTR), which is essential for managing your tax account.

4. Receive and Use Your Unique Taxpayer Reference (UTR)

Your UTR is a 10-digit number that HMRC uses to identify your company. This number is crucial for all tax-related communications and transactions with HMRC. It’s important to keep this number secure and ensure it’s used correctly when filing returns or making payments.

5. Activate and Manage Your Company Tax Account

With your UTR in hand, you can now activate your company tax account through the Government Gateway. Once activated, you’ll be able to manage your tax obligations, including filing returns, making payments, and staying on top of deadlines. Regularly logging into your account will help you stay informed about any updates or requirements from HMRC.

Exploring Company Tax Account Services in the UK

UK businesses have access to a wide range of services designed to simplify tax management and ensure compliance. These services can be especially beneficial for small businesses that may not have the resources to manage their tax affairs in-house. Here’s what these services typically include:

1. Tax Compliance and Reporting

Ensuring compliance with HMRC’s tax regulations is crucial for avoiding penalties. Professional tax services can help you stay on top of filing deadlines, accurately report income and expenses, and ensure that all tax obligations are met.

2. Strategic Tax Planning and Optimization

Strategic tax planning involves identifying opportunities to reduce your tax liability through legal means. This can include taking advantage of tax reliefs, allowances, and deductions that your business may qualify for. A tax professional can provide advice tailored to your specific business needs, helping you optimize your tax strategy.

3. Comprehensive Account Management

Comprehensive account management services can handle all aspects of your company’s tax obligations, from setting up payment plans to managing correspondence with HMRC. This allows you to focus on running your business without worrying about the complexities of tax management.

4. Advanced Tax Software Solutions

Using specialized tax software can streamline the process of managing your company’s tax account. These tools often integrate with your existing financial systems, making it easier to file returns, track payments, and maintain accurate records. Many software solutions also offer features such as automatic deadline reminders and real-time reporting, which can significantly reduce the risk of errors.

Key Deadlines and Filing Requirements for UK Company Tax Accounts

Missing tax deadlines can result in penalties and interest charges, making it crucial to stay informed about the key filing requirements. Here are the primary deadlines that UK businesses need to be aware of:

1. Corporation Tax Filing Deadline

Your company’s Corporation Tax return (CT600) must be filed within 12 months of the end of your accounting period. However, the payment for Corporation Tax is due within nine months and one day after the end of your accounting period. It’s important to prepare your accounts in advance to avoid any last-minute rushes.

2. VAT Filing Deadlines

If your company is VAT-registered, VAT returns must be filed quarterly. The deadline is typically one month and seven days after the VAT period ends. Ensuring that your records are accurate and up-to-date will help you file your VAT returns on time and avoid any penalties.

3. PAYE and National Insurance Contributions

For companies with employees, PAYE and National Insurance contributions must be submitted to HMRC by the 22nd of each month if paying electronically (or by the 19th if paying by cheque). Late payments can result in penalties, so it’s essential to manage payroll effectively.

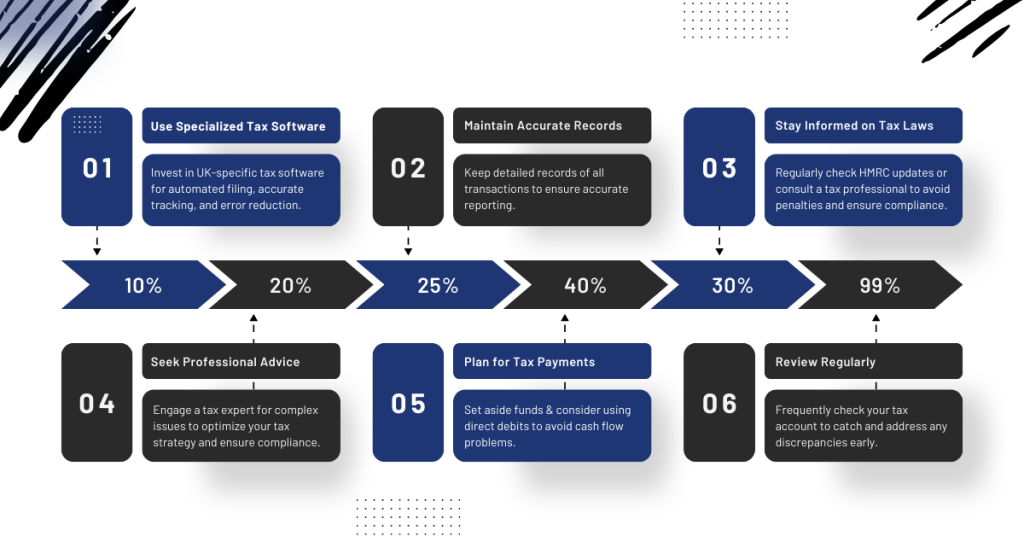

Best Practices for Managing Your Company Tax Account

Managing your company tax account efficiently can save you time, reduce stress, and minimize the risk of costly errors. Here are some best practices to help you manage your tax obligations effectively:

1. Implement Specialized Tax Software

Investing in tax software tailored to UK businesses can significantly ease the burden of tax management. These tools can help automate the filing process, track payments, and ensure that all tax-related activities are recorded accurately. The use of software also reduces the risk of human error, which can lead to costly mistakes.

2. Keep Comprehensive and Accurate Records

Maintaining detailed records of all financial transactions is essential for accurate tax reporting. This includes keeping receipts, invoices, and other documentation that supports your income and expenses. Proper record-keeping ensures that you can provide accurate information to HMRC and helps in the event of an audit.

3. Stay Updated on Tax Legislation

UK tax laws are continually evolving, and staying informed about these changes is crucial for maintaining compliance. Regularly reviewing HMRC updates or consulting with a tax professional can help you stay ahead of any new regulations that may affect your business.

4. Seek Professional Tax Advice

While it is possible to manage your tax affairs independently, seeking professional advice can provide valuable insights, particularly in complex situations. Tax professionals can help you navigate the intricacies of tax law, optimize your tax strategy, and ensure that you are fully compliant with HMRC regulations.

5. Plan Ahead for Tax Payments

One of the most effective ways to manage your company tax account is to plan ahead for tax payments. Setting aside funds throughout the year can help you avoid cash flow issues when it’s time to pay your tax bill. Additionally, consider setting up direct debits with HMRC to automate payments and reduce the risk of missing deadlines.

6. Review Your Tax Account Regularly

Regularly reviewing your company tax account services for UK businesses is essential to staying on top of your obligations and quickly addressing any issues that come up. By checking your account frequently, you can catch discrepancies early and take corrective action before they turn into bigger problems.

Conclusion

A company tax account is essential for any UK business, offering a central platform to manage tax obligations, ensure compliance, and optimize liabilities. Effective tax management requires diligence, planning, and the right tools, such as online accounting services in the UK. Whether you’re a small business owner or managing a larger enterprise, staying organized and proactive will help you navigate UK tax laws confidently, allowing you to focus on growing your business. By staying informed and using the right resources, your company tax account becomes a strategic asset that drives your business’s success.

FAQs

- What is a company tax account in the UK?

A company tax account is an online portal provided by HMRC where businesses can manage their tax obligations, including Corporation Tax, VAT, and PAYE.

- How do I set up a company tax account in the UK?

You can set up a company tax account by registering your business with Companies House, creating a Government Gateway account, and registering for Corporation Tax with HMRC.

- What are the deadlines for filing Corporation Tax in the UK?

The Corporation Tax return (CT600) must be filed within 12 months of your company’s accounting period. Payment of Corporation Tax is due within nine months and one day after the accounting period ends.

- Can I manage my company tax account using software?

Yes, there are specialized software solutions available that integrate with your financial systems to help manage tax filings, track payments, and maintain accurate records.

- What happens if I miss a tax filing deadline in the UK?

Missing a tax filing deadline can result in penalties and interest charges from HMRC. It’s important to stay on top of all deadlines to avoid these additional costs.

- Do I need professional help to manage my company tax account?

While it’s possible to manage your tax account independently, professional assistance can provide valuable expertise, especially for complex tax situations or to optimize tax planning.