Flat Glass Market in Europe 2024:

How Big is the Europe Flat Glass Industry?

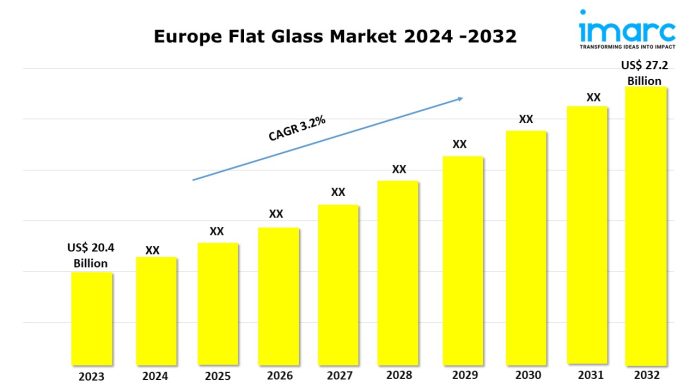

The Europe flat glass market size reached USD 20.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 27.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.2% during 2024-2032.

| Report Attribute | Key Statistics |

| Base Year | 2023 |

| Forecast Years | 2024-2032 |

| Historical Years | 2018-2023 |

| Market Size in 2023 | US$ 20.4 Billion |

| Market Forecast in 2032 | US$ 27.2 Billion |

| Market Growth Rate (2024-2032) | 3.2% |

Request Free Sample Report: https://www.imarcgroup.com/europe-flat-glass-market/requestsample

Europe Flat Glass Market Trends:

The market in Europe is primarily driven by the increasing demand from the construction and automotive industries. As governments and regulatory bodies in Europe push for stringent energy-saving regulations, the demand for energy-efficient glazing and insulated glass units (IGUs) has significantly increased. In addition to construction, the automotive industry plays a crucial role in driving the flat glass market.

The rising production of vehicles in Europe, particularly electric vehicles (EVs), has contributed to the demand for lightweight, durable flat glass used in windows, windshields, and sunroofs. Advanced glass technologies, such as laminated and tempered glass, provide enhanced safety, soundproofing, and UV protection, making them highly desirable for automotive applications. Additionally, technological advancements, including self-cleaning and smart glass, are enhancing the functionality and appeal of flat glass products.

Europe Flat Glass Market Scope and Growth Analysis:

The scope of the Europe flat glass market is broad, encompassing various types of glass products, including tempered glass, laminated glass, insulated glass, and coated glass. The market serves several industries, with major applications in construction, automotive, and solar energy sectors. The use of flat glass in solar panels is another key area of growth, as Europe continues to invest in renewable energy projects. With the increasing focus on sustainability, demand for glass products with eco-friendly properties, such as low-emissivity (Low-E) glass, has surged, adding to the market’s expansion. In terms of market analysis, Europe is one of the largest markets for flat glass, with countries like Germany, France, Italy, and the UK leading in production and consumption. The construction sector remains the dominant end-user, driven by the ongoing development of residential and commercial infrastructure. As governments encourage the adoption of green building standards, demand for energy-efficient and eco-friendly glass is expected to rise.

Regulations, such as the European Energy Performance of Buildings Directive (EPBD), mandate the use of high-performance glazing to improve energy efficiency, further driving market growth. The automotive sector is also a key contributor, particularly with the rising production of electric and hybrid vehicles, which demand lightweight, high-performance flat glass. Manufacturers are increasingly focusing on producing advanced glass that enhances the safety, comfort, and aesthetics of vehicles. The adoption of innovative technologies like smart glass, which can regulate light and temperature, and switchable privacy glass, is further expanding the scope of flat glass applications in both automotive and construction industries.

Europe Flat Glass Industry and Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Europe flat glass market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Breakup by Technology:

- Float Glass

- Sheet Glass

- Rolled Glass

Breakup by Product Type:

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Insulated

- Extra Clear Glass

- Others

Breakup by Raw Material:

- Sand

- Soda Ash

- Recycled Glass

- Dolomite

- Limestone

- Others

Breakup by End Use:

- Safety and Security

- Solar Control

- Others

Breakup by Type:

- Fabricated

- Non-Fabricated

Breakup by End Use Industry:

- Construction

- Automotive

- Solar Energy

- Electronics

- Others

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Top Players Analysis:

The report provides a detailed analysis of the competitive environment. It covers various aspects such as market structure, positioning of key players, top strategies for success, a competitive dashboard, and a company evaluation quadrant. Furthermore, the report includes comprehensive profiles of all major companies.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=3265&flag=C

Key highlights of the Report:

- Recent Industry News

- Key Technological Trends & Development

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145