Digital Lending Platform Market Scope and Overview

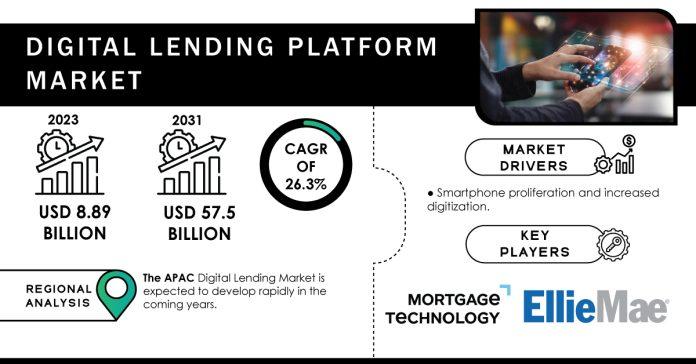

The Digital Lending Platform Market has evolved significantly in recent years, driven by technological advancements and the increasing demand for streamlined, efficient lending processes. Digital lending platforms utilize technology to enhance various stages of the lending cycle, from origination and approval to management and compliance. These platforms offer a range of solutions that facilitate faster, more accurate, and more secure lending operations. As the financial industry continues to embrace digital transformation, the digital lending platform market is poised for substantial growth.

The Digital Lending Platform Market is growing as financial institutions and lenders adopt digital solutions to streamline and automate the lending process. Digital lending platforms enable online loan applications, credit assessments, and approvals, providing a more efficient and user-friendly experience for borrowers. The market is driven by the increasing demand for faster loan processing, the rise of fintech innovations, and the need for improved customer experiences. Digital lending platforms offer benefits such as reduced processing times, enhanced data analytics, and increased accessibility. As digital transformation continues in the financial sector, the adoption of digital lending platforms is expected to rise.

Competitive Analysis

The digital lending platform market is highly competitive, with several key players leading the industry. These companies offer a variety of solutions designed to improve the efficiency and effectiveness of the lending process. Major players in the market include:

- Black Knight

- Ellie Mae

- Finastra

- Fis

- Fiserv

- Intellect Design Arena

- Nucleus Software Exports

- Tavant

- Temenos

- Wipro Limited

- Other Players

Digital Lending Platform Market Segmentation

The digital lending platform market is segmented based on solution, service, deployment mode, and vertical. Each segmentation provides insights into the different aspects of the market and the diverse needs of various stakeholders.

On The Basis of Solution

- Business Process Management: This solution focuses on automating and optimizing lending processes, including application processing, approval workflows, and document management. It aims to improve efficiency, reduce processing times, and enhance overall operational effectiveness.

- Lending Analytics: Lending analytics solutions provide data-driven insights into lending operations, helping organizations make informed decisions, manage risk, and identify opportunities for improvement. These solutions leverage advanced analytics and reporting tools to support strategic planning and performance management.

- Loan Management: Loan management solutions encompass various tools and functionalities for managing the entire loan lifecycle, from origination to servicing and collection. These solutions aim to streamline operations, enhance customer service, and ensure compliance with regulatory requirements.

- Loan Origination: Loan origination solutions facilitate the initial stages of the lending process, including application submission, credit assessment, and approval. These solutions focus on improving efficiency, reducing processing times, and enhancing the customer experience.

- Risk & Compliance Management: Risk and compliance management solutions address the need for regulatory compliance and risk mitigation in the lending process. These solutions provide tools for monitoring and managing risk, ensuring adherence to regulatory requirements, and maintaining data security.

- Others: This category includes additional solutions that support various aspects of the lending process, such as document management, e-signatures, and customer relationship management (CRM) tools.

On The Basis of Service

- Design and Implementation: This service involves the planning, design, and deployment of digital lending solutions, ensuring that they are tailored to meet the specific needs of the organization and integrated with existing systems.

- Training and Education: Training and education services focus on equipping users with the knowledge and skills needed to effectively use digital lending platforms. These services include training programs, workshops, and educational resources.

- Risk Assessment: Risk assessment services provide tools and methodologies for evaluating and managing risk in the lending process. These services help organizations identify potential risks, assess their impact, and implement strategies to mitigate them.

- Consulting: Consulting services offer expert advice and guidance on various aspects of digital lending, including technology selection, process optimization, and strategy development. These services help organizations make informed decisions and achieve their digital transformation goals.

- Support and Maintenance: Support and maintenance services ensure the ongoing functionality and performance of digital lending solutions. These services include technical support, system updates, and maintenance activities to address issues and ensure optimal performance.

On The Basis of Deployment Mode

- Cloud: Cloud-based deployment involves hosting digital lending solutions on remote servers accessible via the internet. This deployment mode offers benefits such as scalability, cost-effectiveness, and remote accessibility, making it an attractive option for many organizations.

- On-premises: On-premises deployment involves installing digital lending solutions on servers and infrastructure within the organization’s premises. This deployment mode provides greater control over data and security but may require higher upfront costs and maintenance efforts.

On The Basis of Vertical

- Banking: In the banking sector, digital lending platforms are used to streamline loan origination, management, and servicing processes. These platforms help banks enhance customer experience, reduce processing times, and improve operational efficiency.

- Financial Services: Financial services organizations use digital lending platforms to manage various types of loans and credit products. These platforms support efficient processing, risk management, and compliance within the financial services industry.

- Insurance: Insurance companies leverage digital lending platforms to offer insurance-related loans and financing options. These platforms help insurers manage loan portfolios, assess risk, and improve customer service.

- Credit Unions: Credit unions use digital lending platforms to provide members with efficient and convenient lending services. These platforms support loan origination, management, and servicing for credit union members.

- Retail Banking: Retail banking involves providing financial services to individual consumers, and digital lending platforms play a crucial role in facilitating personal loans, mortgages, and other retail lending products.

- P2P Lenders: Peer-to-peer (P2P) lending platforms use digital technology to connect borrowers with individual investors. These platforms enable P2P lenders to manage loan origination, risk assessment, and investor relations efficiently.

Key Growth Drivers of the Digital Lending Platform Market

Several factors are driving the growth of the digital lending platform market:

- Organizations across industries are adopting digital transformation strategies to improve efficiency, reduce costs, and enhance customer experiences. Digital lending platforms play a crucial role in this transformation by automating and optimizing lending processes.

- The growing adoption of cloud technology enables organizations to deploy digital lending solutions with greater flexibility, scalability, and cost-effectiveness. Cloud-based solutions offer remote accessibility and reduce the need for on-premises infrastructure.

- The demand for faster, more efficient lending processes is driving the adoption of digital lending platforms. Automation reduces manual processes, speeds up loan approval times, and enhances operational efficiency.

- Stringent regulatory requirements in the lending industry necessitate robust compliance and risk management solutions. Digital lending platforms provide tools to ensure adherence to regulations and mitigate risk.

- Technological advancements, including artificial intelligence, machine learning, and data analytics, are enhancing the capabilities of digital lending platforms. These technologies improve decision-making, risk assessment, and customer engagement.

Impact of Recent Global Events on the Digital Lending Platform Market

Recent global events, including the Russia-Ukraine conflict and economic uncertainties, have significantly impacted the digital lending platform market:

- The pandemic accelerated the adoption of digital technologies as organizations sought to adapt to remote work and digital interactions. This trend has driven increased demand for digital lending solutions that support remote loan applications and approvals.

- Economic uncertainties and financial challenges have heightened the need for effective risk management and compliance solutions. Digital lending platforms offer tools to assess and manage risk in a rapidly changing economic environment.

- The pandemic has shifted consumer behavior towards digital channels and online services. This shift has increased the demand for digital lending platforms that provide convenient and accessible lending solutions.

Key Objectives of the Market Research Report

The market research report on digital lending platforms aims to achieve the following objectives:

- The report provides a comprehensive analysis of market trends, dynamics, and growth prospects, offering insights into the current and future state of the digital lending platform market.

- The report assesses the competitive landscape, including key players, their strategies, and market positioning, to identify opportunities and challenges in the market.

- The report explores market segmentation by solution, service, deployment mode, and vertical, providing a detailed view of market dynamics and applications.

- The report evaluates regional trends and growth prospects, highlighting key markets and opportunities across different geographic regions.

- The report identifies key growth drivers and challenges influencing the market, offering insights into factors shaping the industry’s development.

Conclusion

The digital lending platform market is experiencing significant growth, driven by technological advancements, increased demand for digital transformation, and evolving consumer behavior. Key players in the market are offering innovative solutions to enhance the efficiency, effectiveness, and security of the lending process. The market’s segmentation into various solutions, services, deployment modes, and verticals provides valuable insights into its diverse applications and needs. As the market continues to evolve, the key growth drivers and recent global events will shape its development, presenting opportunities for further innovation and expansion. The digital lending platform market is well-positioned to meet the demands of a rapidly changing financial landscape and support the future of lending.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Digital Lending Platform Market Segmentation, by Solution

- Digital Lending Platform Market Segmentation, by Service

- Digital Lending Platform Market Segmentation, by Deployment Mode

- Digital Lending Platform Market Segmentation, by Vertical

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Digital Transformation Market Trends

Data Pipeline Tools Market Report