Today, medical progress has greatly improved the chances of surviving critical illnesses. However, the financial costs of dealing with such diseases remain a concern. Critical illness insurance bridges the gap between what health insurance pays and the expenses of managing a critical illness.

This article will discuss how critical illness healthcare insurance can help individuals and their families in 2024. But before that, first, understand what critical illness healthcare insurance is. So, let’s get started.

What is Critical Illness Healthcare Insurance?

Critical illness healthcare insurancе is a type of insurancе that pays a lump sum amount to thе policyholdеr if thеy arе diagnosed with a specific life-threatening disease such as cancer and heart attack and kidnеy failurе and еtc.

The bеnеfit can bе usеd to cover medical expenses and loss of income and or any other costs related to thе illness. Critical illness insurancе differs from health insurancе as it does not reimburse the expenses incurred but provides a fixed amount regardless of the treatment costs.

How Critical Illness Healthcare Insurance Works?

Critical illness insurance is a type of insurance where the person who has the policy gets a one-time payment if they get sick with a certain illness that the policy covers. This money can be used to pay for medical bills, make up for lost wages, or pay for any other financial need.

The person with the policy pays a regular fee to keep the insurance. The important thing to remember is that the money is given when the person is diagnosed with the illness, not based on how much they spent on medical bills.

What are the Features of a Critical Illness Healthcare Insurance?

A critical illness policy comes loaded with various features that provide comprehensive protection against listed critical illnesses. Some of these features are as follows:

1. Critical Illness Coverage

This refers to the list of critical illnesses and medical conditions covered under the policy. The coverage varies from insurer to insurer, but it typically includes significant illnesses like cancer, heart attack, kidney failure, and more.

2. Lump-sum Payment

The policyholder receives a lump-sum amount from the coverage list upon critical illness diagnosis. This can cover medical expenses, pay off debts, or compensate for a reduced income due to illness.

3. Renewability and Premiums

Most critical illness policies offer lifetime renewability, allowing the policyholder to renew the policy for life. The premium, the amount paid for the policy, may vary based on factors like age, health condition, and the sum insured.

4. Survival Period

The survival period is the minimum number of days the policyholder must survive post-diagnosis to make a claim. Depending on the policy, this period can vary from 15 to 30 days.

5. No Medical Bills Required

Unlike regular health insurance, critical illness healthcare insurance does not require the submission of medical bills for claim settlement. The payout is made based on the diagnosis itself.

How Does Critical Illness Healthcare Insurance Help Your Family?

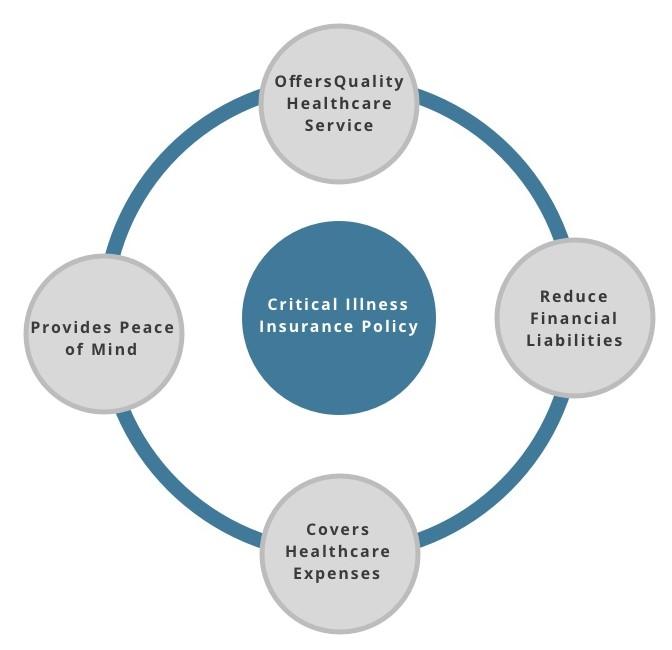

A critical illness healthcare insurance policy not only helps one, but also their family in case of a medical emergency or a financial crisis. Some of the ways how a critical illness healthcare insurance policy can help your family are:

1. Financial Security

Critical illness healthcare insurance pays out a lump sum amount upon the diagnosis of a covered condition. This can help cover medical bills, household expenses, and other financial obligations, reducing the financial burden on their family.

2. Coverage for Expensive Treatments

Many critical illnesses require expensive treatments and procedures. This insurance helps cover these costs, ensuring they receive the necessary care without worrying about the expenses.

3. Rehabilitation Costs

Recovery from a critical illness often involves rehabilitation and follow-up care. Their critical illness healthcare insurance can also cover these costs, providing further financial support.

4. Protection of Savings

Families often dip into their savings or retirement funds to cover medical costs without insurance. Critical illness insurance protects these funds by providing the necessary financial support.

Wrapping Up

Life is unpredictable, so investing in Critical Illness Insurance is a wise and strategic decision. This insurance acts as a safety net, protecting you and your family from the financial impact of a serious health problem. One of the best health insurance company options is Niva Bupa Health Insurance.

Niva Bupa Health Insurance provides various critical illness policies. These policies allow one to concentrate on their well-being. Their policies include a wide range of hospitals accepting cashless payments and a quick-claim handling process so that you have peace of mind during such times.